OLED Market by Display Application (Smartphone, TV, Automotive, NTE), Panel Type (Rigid, Flexible), Technology, Size, Material (FMM RGB, WOLED), Lighting Application (General, Automotive), Panel Type, & Vertical, and Geography - Global Forecast to 2023

The global OLED market was valued at USD 16.58 billion in 2016 and is expected to grow at a CAGR of 15.2% between 2017 and 2023. The key factors driving the growth of the market include the rapid adoption of OLED displays in smartphones and the growing investments in technology and manufacturing facilities. The base year considered is 2016, and the forecast period for the market has been considered between 2017 and 2023.

Market Dynamics

Growing investments in OLED technology and manufacturing facilities

OLED is a new and exciting technology providing thin, efficient, and bright displays and lighting solutions. Many industry experts believe OLEDs are set to replace existing technologies in display and lighting space. In a view of this, many companies started investing heavily in R&D of OLED. There are several players involved in the value chain of the market; these include companies researching on OLEDs and acquire important patents relating to OLED materials; chemical companies involved in the OLED material production; panel manufacturers, and customers that use OLEDs in their products such as smartphones, TVs, and other consumer electronic products.

For instance, in February 2015, LG Display announced its plan to invest USD 915 million for the OLED TV production capacity expansion. This expansion enabled LG Display to produce 0.6 and 1.5 million OLED panels for TV in 2015 and 2016, respectively.

Companies such as BOE Technology (China), Tianma Microelectronics (China), Truly Semiconductors (China), AU Optronics (Taiwan), EverDisplay Optronics (China), GoVisionox Optoelectronics (China), and JOLED (Japan) have already announced the OLED production capabilities with partial production in 2016 and mass production by 2018.

Objective Of The Study

To define, describe, and forecast the organic light emitting diodes (OLED) market, in terms of value, segmented on the basis of OLED display and OLED lighting

To define, describe, and forecast the OLED display market, in terms of value, segmented on the basis of application, technology, panel type, and panel size

To define, describe, and forecast the AMOLED display market segmented on the basis of material

To define, describe, and forecast the OLED display market, in terms of volume, segmented on the basis of application

To define, describe, and forecast the OLED lighting market segmented on the basis of application, panel type, and vertical

To define, describe, and forecast the OLED market for displays and lightings, in terms of value, with regard to 4 main regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

To identify and analyze major factors influencing the growth of the OLED market (drivers, restraints, opportunities, and industry-specific challenges)

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

To analyze key trends related to the OLED display market and the OLED lighting market that shape and influence the overall OLED market

To analyze market opportunities for stakeholders and provide details of the competitive landscape of key players

To analyze strategic developments such as mergers and acquisitions, expansions, product launches and developments, and R&Ds, among others, in the overall OLED market

To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for market leaders

Research Methodology

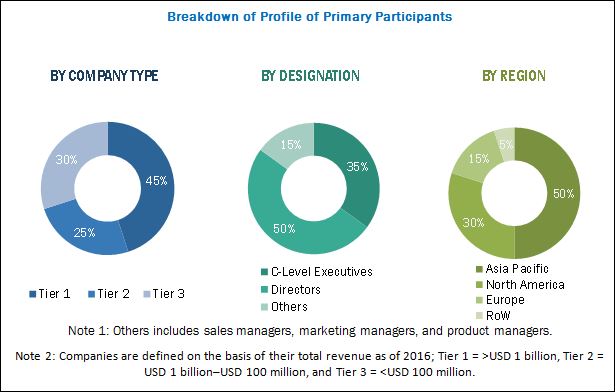

The research methodology includes the use of primary and secondary data. Both top-down and bottom-up approaches have been used to estimate and validate the size of the market, as well as the other dependent submarkets. Key players in the market have been identified through secondary research. Secondary sources include references such as annual reports, company press releases, Factiva, and investor presentations of companies; white papers, consumer electronics exhibitions, certified publications; websites; directories; and databases. All the percentage shares and breakdowns have been determined by using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The breakdown of the profiles of the primaries has been depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

This report provides valuable insights regarding the ecosystem of OLED market, such as research & development, material development, display and lightning panel manufacturing, device assembly and testing, distribution, marketing & post-sales service. Key players operating in the market include Samsung Electronics (South Korea), LG Display (South Korea), AU Optronics Corp. (Taiwan), JOLED (Japan), and Universal Display Corp. (US). Other major players in the market are Foxconn (Sharp Corp. & Innolux Corp.), Pioneer Corporation (Japan), BOE Technology (China), Royole Corporation (US), Everdisplay Optronics (China), Acuity Brands (US), OSRAM (Germany), Kaneka Corporation (Japan), and OLEDWorks (US).

Target Audience

Display and lighting panel manufacturers

Material suppliers

Glass substrate manufacturers

Display manufacturing equipment suppliers

Electronics and semiconductor companies

Original brand manufacturers

Companies in solid state lighting (SSL), photonics, and optoelectronics markets

Research laboratories and IP companies

Systems integration specialists

Research institutes and organizations

Market research and consulting firms

Research Scope

The market covered in this report has been segmented as follows:

OLED Display Market, by Application:

OLED Display Market, by Display Panel Type:

OLED Display Market, by Display Panel Size:

Upto 6 Inches

6–20 Inches

20–50 Inches

More than 50 Inches

OLED Display Market, by Display Technology:

AMOLED Display Market, by Material

OLED Lighting Market, by Application

General Lighting

Automotive Lighting

OLED Lighting Market, by Panel Type

OLED Lighting Market, by Vertical:

Commercial

Automotive

Sports & Entertainment

Residential

Industrial

OLED Market, by Region:

Asia Pacific (APAC)

South Korea

China

Japan

Taiwan

India

Rest of APAC

North America

Europe

UK

Germany

France

Finland

Rest of Europe

RoW

Middle East

Africa

South America

Key Questions

How much growth is expected in OLED market from smart wearables, and why OLED is essential for AR/VR growth?

Which are the top use cases/applications/industries of OLEDs to invest in, and what are the untapped opportunities?

Who are the major current and potential competitors in the market, and what are their top priorities, strategies, and developments?

How the demand for OLED displays will shape in the next 5 years for newer and emerging applications?

Where will the current developments take the OLED supply chain in the mid to long term?

Available Customizations

With the given market data, MarketsandMarkets offers the following customization options available for the report.

Competitive Landscape

Detailed analysis and profiling of additional market players

Revenue impact of OLED growth on Samsung and LG Display

Detailed analysis and profiling of key input suppliers (material suppliers and manufacturing equipment suppliers) in OLED supply chain

Industry-Specific Data

Impact of OLED growth on LCD display panel market and unknown impact on LCD component/material suppliers

Opportunities offered by automotive and AR/VR in OLED market

Detailed analysis of specific industry and respective use cases or applications for OLED

Government regulations, compliances across industries, and major initiatives across different geographies in lighting space

Organic light-emitting diode (OLED) emerged as an advanced and self-emitting display technology for efficient, bright, flexible, and thin display panels. OLED displays are made from organic light-emitting materials and do not require any backlight panel. Since 2015, OLEDs have witnessed rapid adoption in smartphones and wearables. The global OLED market was valued at USD 16.58 billion in 2016 and is expected to reach USD 48.81 billion by 2023, at a CAGR of 15.2% between 2017 and 2023. The key factors driving the growth of market include the rapid adoption of OLED displays in smartphones and the huge investments in the technology and manufacturing facilities.

Smartphones accounted for major share of 83.5% in OLED display panel market in 2016. The major factors that are boosting the use of OLED displays in smartphones include the benefits offered by OLED including energy-efficiency, high brightness, and thin form factor compared with LCD display panels. AMOLED screens have great contrast, as the light on the screen comes from each individual pixel rather than an LED backlight; when it needs to create a black color, it simply dims or turns off the relevant pixels, for a true, deep black, which consumes less power. Televisions are likely to account for the second-largest share of the display market by 2023. The OLED lighting market is at the early phase of growth and is expected to grow at a high CAGR during the forecast period.

Flexible display panels held a lower market share compared rigid ones in 2016; however, the market for flexible display panels is expected to grow at a higher rate during the forecast period. With the increasing use of flexible display panels in smartphones and smart wearable devices, and their potential use in other applications such as TVs, signage displays, and vehicles, flexible displays are expected to drive the growth of the market during the forecast period.

Fine metal mask (FMM) RGB materials are used to manufacture small display panels for smartphones and tablets; these materials accounted for a larger share of the market for AMOLED displays in 2016. However, the market share of FMM RGB is expected to decline owing to the increasing adoption of WOLED materials by LG Display for use in TVs. Large display panels are used in TVs, which require more OLED materials compared with smartphones and tablets. The full-fledged production of WOLED-based large-sized display panels started in 2015–2016 when LG launched TV and signage displays based on the OLED technology. The consumption of materials for use in large-sized white OLED panels is expected to increase rapidly each year throughout the forecast period.

General lighting accounted for a major share of OLED lighting market in 2016; however, the market for automotive lighting is expected to grow at a higher rate between 2017 and 2023. The high growth in automotive lighting can be attributed to the expected demand from luxury car manufacturers for premium quality lightings, along with the collaboration among OLED manufacturers and leading automotive companies for the development of flexible lightings for vehicles.

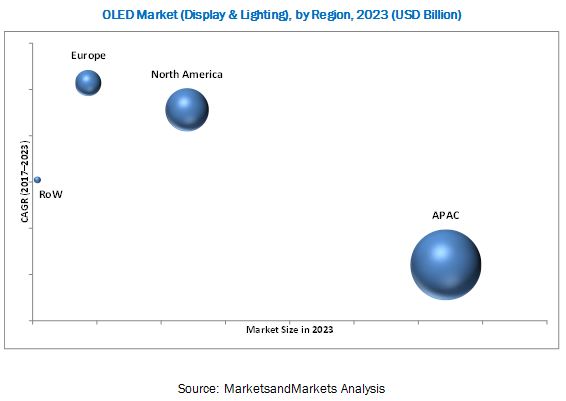

Asia Pacific accounted for the highest demand in OLED market in 2016, especially from South Korea, China, and Japan as major original brand manufacturers are based in these countries. The display market in North America is expected to grow at a high CAGR during the forecast period owing to the increasing adoption of OLED display panels by Apple in its smartphones. Early adoption of OLED lighting panels by leading automotive players in Europe is expected to propel the growth of the lighting market in Europe. Automotive players such as BMW and Audi have used OLED lighting solutions in their cars.

Factors such as high growth of the market for micro-LED and direct-view LED display technologies, and low market acceptance of OLED lighting fixtures are restricting the growth of the market. Samsung Display (South Korea) and LG Display (South Korea) are the leading players in the market; however, various players such as AU Optronics (Taiwan), JOLED (Japan), and BOE Technology (China) are expected to increase their market share in the coming years by constructing new OLED manufacturing plants and acquiring newer customers. The leading players in OLED lighting market are LG Display (South Korea), Acuity Brands (US), OSRAM (Germany), Kaneka Corporation (Japan), Universal Display Corp. (US), and OLEDWorks (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

https://www.marketsandmarkets.com/Market-Reports/oled-market-200.html